The government deficit is not creating savings for the private economy. Savings in the real economy accept public debt as an asset when they perceive the currency issuer’s solvency to be reliable. When the government imposes it and disregards the functioning of the productive economy, positioning itself as the source of wealth, it undermines the very foundation it purports to protect: the standard of living for the average citizen—Daniel Lacalle

In this issue

Philippines’ Debt Amortization Skyrockets to a Record in March! Surging Fiscal Deficit Weakens the PSE and the Philippine Peso

I. Philippines’ Debt Amortization Skyrockets in March Reaching 81% of 2023 Record Levels

II. Driven by Amortizations, Debt Servicing Costs Skyrocketed in Q1 2024: Debt and Debt Servicing in the Shadow of the Asian Financial Crisis

III. Understanding Debt Amortizations

IV. Despite Lackluster Public Spending, March and Q1 2024 Fiscal Deficit Widens

V. Government Spending: The Primary Source of Inflation

VI. Surging Fiscal Deficit Weakens the PSE, the Philippine Peso and Bond Market

Philippines’ Debt Amortization Skyrockets to a Record in March! Surging Fiscal Deficit Weakens the PSE and the Philippine Peso

The Philippine government’s public amortization rocketed by an unprecedented rate last March as Q1 2024 fiscal deficits swelled anew. We elaborate on their implications.

I. Philippines’ Debt Amortization Skyrockets in March Reaching 81% of 2023 Record Levels

When faced with challenging or adverse developments, does the establishment adhere to a code of silence?

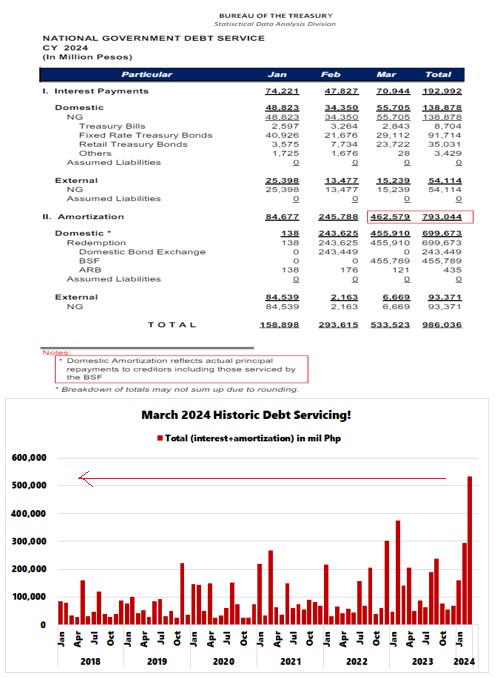

Figure 1

Last week, the Philippines' Bureau of Treasury (BoTr) released its cash operations conditions for March, including its debt servicing report. (Figure 1, upper table)

The most striking revelation was the remarkable spike in debt amortizations last March, which surged by 469.17% YoY to reach a record Php 462.6 billion!

This amount marked the highest monthly figure in the BoTr's records, following the fourth-highest in February 2024.

Its surge propelled total debt servicing (interest payments + amortizations) to an all-time high of Php 986.04 billion! (Figure 1, lower pane)

Great huh?

Figure 2

Compared to historical first quarters, Q1 2024's amortization soared by 74.3%, from Php 423.74 billion to a historic Php 793.04 billion! (Figure 2, topmost window)

Importantly, amortizations reached 81.3% of 2023's aggregate of Php 975.3 billion!

That’s EIGHTY-ONE PERCENT with 9 months or three quarters to go!

Moreover, Q1 2024's amortization data surpassed all other ANNUAL totals, except for 2023. (Figure 2, second to the highest image)

Truly incredible.

In Q1 2024, compared to previous annualized performance, amortizations have constituted a milestone 81.4% share of debt servicing, with interest payments making up the remainder at 19.6%. (Figure 2, second to the lowest graph)

The opacity of amortizations ensconces this radical shift in the pattern of debt servicing.

To diminish reliance on external debt, the government has augmented the share of domestic sources for its amortization schedules. In Q1, domestic financing accounted for a record 85.04% share, with external debt comprising 14.96%. (Figure 2, lowest chart)

II. Driven by Amortizations, Debt Servicing Costs Skyrocketed in Q1 2024: Debt and Debt Servicing in the Shadow of the Asian Financial Crisis

Figure 3

Once more, driven by amortizations, total debt servicing in Q1 2024 reached 61.5% of last year's Php 1.604 trillion! (Figure 3, topmost visual)

That’s right, Q1 2024 debt servicing signifies just 39% below last year's total!

Nonetheless, debt servicing relative to revenues hit an all-time high of 185.3% in March, surpassing February 2023's record of 177.33%.

Meanwhile, debt-to-expenditures reached 110.3%, the second-highest since February 2023's 118.1%. (Figure 3, middle graph)

From previous accounts, the government’s front-loading of the amortizations for the year in Q1 could be a pattern.

While the public may remain nonchalant, largely due to the lack of coverage by the government, media, and institutional mouthpieces, soaring debt and debt servicing will eventually take their toll on the economy.

The Philippines' public debt-to-GDP ratio has risen way above the levels seen during the Asian Financial Crisis, reaching more than TWICE the 1997 levels and just slightly below the record of 62.6% reached in 2021. (Figure 3, diagram)

Meanwhile, the cost of debt servicing relative to GDP has surged to levels last seen in 2011. Despite our repeated warnings about the critical flaws of the debt-to-GDP metric, the increasing reliance on deficit spending amplifies the likelihood of its acceleration. (Prudent Investor, 2021)

However, this 'path-dependent' policy decision to reinforce the unsustainable increase in debt-financed deficit spending through the expansion of domestic borrowing seems to be grounded in the belief that the risks of a domestic debt crisis could be minimized. However, this belief is unfounded.

As noted in the abstract of a 2008 working paper by Ms. Reinhart and Mr. Rogoff,

Our findings on debt sustainability, sovereign defaults, the temptation to inflate, and the hierarchy of creditors only scratch the surface of what the domestic public debt data can reveal. First, domestic debt is big -- for the 64 countries for which we have long time series, domestic debt accounts for almost two-thirds of total public debt. For most of the sample, this debt carries a market interest rate (except for the financial repression era between WWII and financial liberalization). Second, the data go a long ways toward explaining the puzzle of why countries so often default on their external debts at seemingly low debt thresholds. Third, domestic debt has largely been ignored in the vast empirical work on inflation. In fact, domestic debt (a significant portion of which is long term and non-indexed) is often much larger than the monetary base in the run-up to high inflation episodes. Last, the widely-held view that domestic residents are strictly junior to external creditors does not find broad support (Reinhart, and Rogoff 2008) [bold added]

The era of free-money politics may be about to face a rude awakening.

III. Understanding Debt Amortizations

How does the government define debt servicing and amortizations? (bold and italics added)

From the Bureau of Treasury:

Bond Sinking Fund - A fund established for the purpose of eventually retiring a long-term obligation with a lumpy maturity. At maturity, the cumulative payments/contributions to the sinking fund and the interest earnings should match the principal amount of the debt to be paid.

Debt service payments - The sum of loan repayments, interest payments, commitment fees and other charges on foreign and domestic borrowings.

Interest payment - Charges imposed as a consequence of the use of money. It is deemed synonymous with discount or coupon payment when applied to government securities.

Principal repayment - The sum of the first component of debt amortization, i.e., principal repayments for loans payable in regular installments and actual releases for the eventual payment of debt. These are the cash outlays from the Bureau of the Treasury in payment of principal amounts of foreign and domestic borrowings. (BuTr, 2018)

From the Department of Budget and Management:

13. What are net borrowings?

Net borrowings refer to gross borrowing less debt amortization.

14. What liabilities are included under public debt?

Public debt includes obligations incurred by the government and all its branches, agencies and instrumentalities, including those of government monetary institutions. It consists of all claims against the government which may be payable in goods and services, but usually in cash, to foreign governments or individuals or to persons natural or juridical. Obligations maybe:

1) purely financial, i.e., loans or advances extended to the Philippine government, its branches, agencies and instrumentalities;

2) services rendered or goods delivered to the government for which certificates, notes or other evidence of indebtedness have been issued to the creditor; and

3) for external debt such as claims of foreign entities, securities held in trust, nonbonded debts and obligations of the Philippine government to the International Monetary Fund (IMF).

15. What is debt service?

Debt service refers to the sum of debt amortization and interest payments on foreign and domestic borrowings of the national government or the public sector. Under the current system of budgeting, only interest payments are treated as part of the expenditure program because it represents a real expense item, i.e. the cost of borrowed funds, which should form part and parcel of cost of the items financed by the loan Debt principal is treated as an off-budget item because it is merely a return of borrowed funds; hence it is reflected as a financial account. (DBM, 2012)

From the Office of the Ombudsman:

23. What is meant by debt amortization?

Debt Amortization refers to the sum of principal repayments for loans payable by regular installments. It also refers to the annual contribution to the debt sinking fund for debts payable only upon maturity.

30. What is debt service?

Debt Service consists of the repayment of interest and related costs. The payment of principal amortization is no longer included in the budget, but it is included in the cash outflow. The reason for this is that principal payment is a financing transaction rather than an expenditure. (Ombudsman, 2012)

Therefore, amortizations represent, first, the principal repayments of government debt, and second, repayments on the bond sinking fund or other long-term obligations.

As financial transactions, amortizations are excluded from the expenditures. Due to this exclusion, discussions within the establishment regarding this matter have been muted.

Although the amortization factor is likely to slow in the coming months due to its front-loading in Q1, the pace of debt servicing growth will likely surprise a complacent public, especially with the probable entrenchment of "higher for longer" rates.

Be that as it may, the government's increasing reliance on deficit spending to centralize the economy translates to a higher debt load and magnified debt servicing.

This, in turn, is likely to result in a slower economy due to imbalances arising from rising taxes, higher inflation (essentially a tax), and heightened misallocation of resources and finances.

Again, as noted above, a sustained rise in debt increases the risks of a financial and/or economic crisis.

Stagflation, ahoy!

IV. Despite Lackluster Public Spending, March and Q1 2024 Fiscal Deficit Widens

ABS-CBN News, April 24, 2024: The Bureau of Treasury said the Philippines’ budget deficit for March narrowed to P195.9 billion from last year’s P210.3 billion on the back of 11.32 percent year-over-year revenue growth vis-à-vis a 3.18 increase increase in government spending. However, the budget gap in the first quarter stood at P272.6 billion marking a slight increase of 0.65 percent or P1.8 billion from the P270.9 billion fiscal deficit recorded for the same period a year ago. Treasury said revenues in the first quarter hit P933.7 billion, or 14.05 percent higher than in the first three months of 2023. Government spending meanwhile reached P1.2 trillion in the Jan-March period this year.

Figure 4

The base effects played a crucial role in delivering revenue and expenditure performance in March.

Nonetheless, because public spending outsprinted revenues, a wider budget deficit ensued. (Figure 4, topmost image)

The effect of deficit spending on prices remains conspicuous.

The crowding-out effect of public spending has fostered demand-supply imbalances, expressed through rising prices. (Figure 4, second to the top left chart)

Rising aggregate demand, fueled by money supply growth from credit activities of banks and government, has also boosted revenues. (Figure 4, second to the top right graph)

The slowing CPI (from 2Q 2023) has been correlated with subdued revenues and spending measured in pesos.

However, thanks to the government's deficit spending-boosted inflation, Q1 revenues and expenditures hit respective milestone highs in pesos. (Figure 4, lowest diagrams)

Figure 5

Interestingly, the Q1 2024 deficit slightly surpassed last year's budget gap—contrary to government projections of this year's deficit improvement. (Figure 5, topmost window)

While the establishment may rationalize this solely as a first-quarter effect, our humble guess is that this year's deficit will surprise a disinterested and credulous public.

Since the pandemic recession, the government's addiction to free money and expanded power has only become more deeply rooted—where "fiscal stabilizer" has morphed into " fiscal dominance."

Asked differently, where's the recession to justify all of this?

Allocations to LGUs slowed in March; they fell by 3.9% year over year. However, this trend may reverse in the coming months due to the forthcoming elections. (Figure 5, second to the highest graph)

Despite rising by only 16.5% year over year last March, interest payments have clearly been strengthening their upside momentum. (Figure 5, second to the lowest chart)

The government’s liquidity conditions have also declined.

Based on Q1 conditions, as the budget gap widened in 2024, cash reserves fell from a record Php 909 billion in 2023 to Php 763.4 billion in 2024, a decrease of Php 145.6 billion. We can infer that the record cash position in January 2024 was intended to address the expansion in debt servicing. (Figure 5, lowest visual)

However, the BoTr reduced its financing from Php 900.7 billion in 2023 to Php 737 billion in 2024, a decline of Php 164.1 billion.

V. Government Spending: The Primary Source of Inflation

Economist Daniel Lacalle wrote, (bold added)

The only real cause of inflation is government spending. While banks can generate money -credit- through lending, they rely on projects and investments to support these loans. Banks cannot create money to bail themselves out. No financial entity would go bankrupt then. In fact, banks’ largest asset imbalance comes from lending at rates below the cost of risk and having government loans and bonds as “no-risk” investments, two things that are imposed by regulation, law, and central bank planning. Meanwhile, the state does issue more currency to disguise its fiscal imbalances and bail itself out, using regulation, legislation, and coercion to impose the use of its own form of money (Lacalle, 2024)

How does the government finance its deficits?

Figure 6

First, it borrows savings from the public (mostly households) through the capital markets. Despite the sustained expansion in bank credit, the secular downtrend in deposit liability growth in the banking system persisted last February, decelerating from 5.98% in January to 5.2%.

The data reveals the declining liquidity position of savers (from the bank’s perspective).

Second, since the government has decided to fund its projects with domestic currency, it has relied on the banking system. Net Claims on the Central Government by banks grew by 12.05% year over year last February to Php 5.02 trillion—slightly lower than the record of Php 5.2 trillion in December 2023.

Third, since the Pandemic recession, the BSP has taken a subordinate role in financing the government. Net Claims on the Central Government by the BSP expanded by 15.8% to Php 850 billion last March—the third highest on record.

So why is the government and the BSP assiduously injecting liquidity when a recession is not at work?

Increasing currency issuance to fund the government’s spending spree magnifies aggregate demand even as it doesn’t contribute to raising output. Rising prices or higher inflation, therefore, are necessary repercussions of government spending.

Needless to say, the erosion of savings stems from the crowding out effect of deficit spending and its natural ramification—inflation.

VI. Surging Fiscal Deficit Weakens the PSE, the Philippine Peso and Bond Market

Figure 7

In any case, it is no surprise that this savings corrosive dynamic has resonated with the PSE’s declining volume.

But the public has been programmed to believe that supply-side bottlenecks have been the source. As such, this is supposedly 'transitory,' even as statistical inflation has been on an uptrend since 2015, and the BSP’s approach to allegedly "counteract" inflation has been through monetary policy—raising rates, which theoretically should raise the cost of borrowing and reduce aggregate demand.

The BSP’s "demonstrated preference" or "action speaks louder than words” exposes the true nature of monetary aspects of inflation (justified by fiscal activities).

The BSP also claimed that they would rise to the occasion to control FX volatility, even as the USD-Philippine peso surged beyond the Php 57 level or their previous 'Maginot Line.' They can certainly stem interim volatility by using up their reserves or accessing FX swap lines or other tools in the central bank toolkit, such as Other Reserve Assets (ORA), but they won’t stop the tide.

This savings-corrosive dynamic should also serve as a barrier to improvements in the domestic bond markets. The Philippine bond market is the second smallest in Asia, according to Asian Bonds Online.

It should come as no surprise that the diminished support from savings only increases systemic risks.

___

References

Daniel Lacalle, Why the U.S. Public Debt Is Unsustainable and It Is Destroying The Middle Class, April 7, 2024

Prudent Investor Newsletter, 1Q 2021 GDP: A Statistic of Government Spending, Debt, Bailouts, and the BSP’s Financial Repression May 16, 2021, Blogspot

Carmen M. Reinhart and Kenneth S. Rogoff, The Forgotten History of Domestic Debt, NBER Working Paper No. 13946 April 2008 JEL No. E6,F3,N0, NBER.org

Bureau of Treasury, BULLETIN NO. 001 – 2018 (2014/12 - 2018/03) NATIONAL GOVERNMENT DEBT STATISTICAL BULLETIN, Bureau of Treasury June 2018, p. 4 to 6 Treasury.gov.ph

Department of Budget and Management, FINANCING OF NATIONAL GOVERNMENT EXPENDITURES, March 2012, dbm.gov.ph

Office of the Ombudsman I. Basic Concepts in Budgeting, Chapter 1 December 2012 Ombudsman.gov.ph

Daniel Lacalle, Governments could stop inflation if they wanted. They will not.; April 21,2024 www.dlacalle.com

No comments:

Post a Comment