All crises have involved debt that, in one fashion or another, has become dangerously out of scale in relation to the underlying means of payment. – John Kenneth Galbraith, A Short History of Financial Euphoria

In this issue

The PSE’s Proposed Capital Controls, Metro Pacific’s Mounting Liquidity Challenges: Is the GSIS Providing an Implicit Backstop?

I. The PSE Proposes its Version of Capital Controls: Raise the Barriers of Exit for Listed Firms

II. Two Perspectives from MPI’s GSIS Transactions

III. Public Financial Institutions as the Core Driver of the PSE’s Liquidity

IV. Possible Reason for Delisting? Metro Pacific’s Intensifying Liquidity Challenges

V. GSIS Expanded Holdings of MPI: A Bailout? An Implicit Backstop?

The PSE’s Proposed Capital Controls, Metro Pacific’s Mounting Liquidity Challenges: Is the GSIS Providing an Implicit Backstop?

The Philippine PSE wants to stanch the "wave of companies" delisting with more rules. Is the GSIS providing a tacit backstop to the liquidity-challenged Metro Pacific? Are public financial firms the core of PSE's liquidity?

I. The PSE Proposes its Version of Capital Controls: Raise the Barriers of Exit for Listed Firms

Inquirer.net, September 4: The Philippine Stock Exchange (PSE) is tightening the rules on voluntary delistings amid a wave of companies going private during the market slump. The PSE is revisiting the guidelines anew after amending the rules in the midst of the COVID-19 pandemic in December 2020. This came as principals of large firms such as infrastructure-focused Metro Pacific Investments Corp. and cement giant Holcim Philippines announced plans to go private at relatively cheaper valuations, frustrating minority stockholders. One of the key features is the scrapping of the 95-percent ownership threshold to successfully complete a voluntary delisting. This also means the bourse’s proposed revisions could make delisting buyouts more costly in certain cases to protect small investors.

A company decides to delist when the cost overshadows the benefits of being a publicly listed company. Those costs include financial, political (regulatory, etc.), economic, a combination of, and even psychic.

The reaction of the PSE manifests the public's mood, reflexively influenced by market actions described hereinto as a "slump," which should be unsurprising.

That is to say, while different reasons may have prompted the "wave of companies" to exit, the bear market could be their common denominator.

Since mainstream institutions have programmed the public's perception of the stock market as an "entitlement," its parallelism in expectations is that speculations deliver "prosperity."

In turn, aside from amplifying volatility, the ramifications of the overriding sentiment—driven by high-time preference or short-term orientation—have been to consume capital.

Turning the stock market into a "casino" has led to material shrinkages in peso volume, which are symptomatic of decreased savings/capital.

Ergo, in response to popular pressures, the PSE proposes to increase the cost of "barriers to exit" to discourage delisting. In essence, it is the PSE's version of capital controls.

If the PSE does that, high "barriers to exit" will likely transform into high "barriers to entry."

Goodbye to those IPO goals.

Worse, it could also motivate other listed companies to head for the exit doors before its enforcement.

Nonetheless, these collective "denials" reinforce the symptoms of a bear market.

II. Two Perspectives from MPI’s GSIS Transactions

One of the week's prominent developments has been the positioning for Metro Pacific's delisting, which may have culminated with the GSIS's increased exposure to the firm last September 4th.

Inquirer.net, September 5: State pension fund Government Service Insurance System (GSIS) delivered a surprise on Tuesday as it announced an increase in its stake in Manuel V. Pangilinan-led Metro Pacific Investment Corp. by nearly four times to about 12 percent days before the conclusion of the company’s P55-billion privatization bid…GSIS’ upsized stake, worth about P17.8 billion at the tender offer price of P5.20 per share, gives the pension fund enough boardroom sway to block the delisting plan…But several market observers said GSIS was likely strengthening its position to negotiate better buyout terms from the bidding consortium—composed of Indonesian tycoon Anthoni Salim’s First Pacific Group, the Ty family conglomerate GT Capital Holdings, Japan’s Mitsui Group and Manuel V. Pangilinan, chair and CEO of Metro Pacific…Then through a letter to Metro Pacific on Sept. 4, it was revealed that GSIS was aggressively buying the company’s shares from Aug. 23 through Sept. 4, acquiring 2.49 billion shares during this period to arrive at its present stake of 11.98 percent. GSIS shares are classified as public shareholdings, meaning the bidding consortium would need to purchase these to reach the required 95 percent ownership threshold before proceeding with the voluntary delisting. GSIS’ stake would be considered nonpublic once it obtains a board seat in the company, based on a series of revisions being proposed by the PSE.

PSE, September 5: Metro Pacific Investments Corporation (MPIC) received a letter from GSIS dated September 4, 2023 informing MPIC that during the period from August 23,2023 to September 4,2023, GSIS purchased 2,490,509,574 common shares of MPIC. GSIS also mentioned that as a result of these purchases, GSIS owns 3,438,549,038 common shares which represents approximately 11.98% of the total outstanding common shares of MPIC.

Here are two perspectives from last week's event.

First, Public financial institutions may be dominating the trading activities at the PSE.

Two, the increased MPI shareholdings of GSIS may represent insurance against the financial risk.

III. Public Financial Institutions as the Core Driver of the PSE’s Liquidity

Monday's trading could be one for the books.

The Php 9.011 billion volume of Metro Pacific [PSE: MPI] accounted for 81.96% and 79.6% of the Php 10.995 billion main board (MB) and Php 11.322 billion total turnover.

Cross trades of MPI shares accounted for over Php 4 billion. As such, the top 10 brokers shanghaied 74.7% share of the mainboard trading volume.

Alternatively, ex-MPI shares, the MB, and the total volume shrunk to an incredible Php 1.984 billion and Php 2.311 billion, respectively.

This means that while the attention shifted to MPI, liquidity in the broader market dissipated.

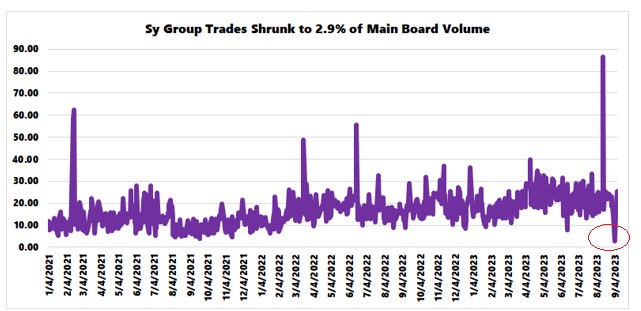

As evidence, the volume in pesos and % share of the Sy group of companies (SM, SMPH, and BDO) representing the top 3 PSEi 30 heavyweights plummeted to 2.9%, a multi-year low. Meanwhile, cumulative peso volume receded to a mere Php 318 million!

To this point, institutional investors, most likely represented by public financial firms like GSIS, could be the core source of the PSE's liquidity.

In any case, the increased exposure by the GSIS on MPI could further reduce the market's liquidity should the (tender offer) sellers of MPI opt not to plow back the sales proceeds to the PSE.

Since the GSIS announcement, MB trading volume has averaged less than Php 3.5 billion daily!

IV. Possible Reason for Delisting? Metro Pacific’s Intensifying Liquidity Challenges

Departing from the Overtone Window on MPI's delisting, as propounded last May, deteriorating liquidity conditions could signify a critical factor in the company's decision.

I could be wrong; however, does the unrecognized/unappreciated "intrinsic value" constitute the outgrowth of debt over income in the face of falling cash reserves?

Could taking MPI into the private indicate its undertaking remedial liquidity measures through ownership restructuring—post-delisting? That's a guess, though. (Prudent Investor, May 2023)

MPI's Q2 17-Q provides us an overview.

Figure 2

The downward sloping trend of MPI's cash reserves has more than halved since Q1 2020.

For the first time, short-term debt of Php 35.64 billion surpassed its cash reserves of Php 29.10 billion. MPI's current ratio was .68 for the period.

Nominal debt has been outpacing gross revenues.

Figure 3

In marginal net peso changes, sales increased by Php 2.8 billion in Q2 YoY, while debt expanded by Php 22 billion. Net income? Php 1.694 billion. So MPI borrowed Php 10.6 pesos for every Php 1 of sales growth and Php 13 for every peso of net income increase.

Interest expense? Php 899 million increase in Q2 YoY. Interest expense has mirrored the surge in BSP rates, which has been gnawing at the profit margins.

Clearly, the liquidity-challenged position by MPI has had a crucial role in its decision to delist.

All these assume the accuracy of the published 17Q.

V. GSIS Expanded Holdings of MPI: A Bailout? An Implicit Backstop?

Now, to the expanded exposure of GSIS (in my humble opinion).

If this tender offer event tacked in sales of some treasury shares, this represents a partial bailout by the GSIS of MPI.

Nevertheless, the expanded exposure of GSIS provides an implicit backstop on MPI. Should MPI encounter financial turbulence, GSIS could appeal to the BSP and DoF (or even the Office of the President) for a bailout on the pretext that the latter's beneficiaries could be at stake.

In any case, the surge of GSIS exposure as the liquidity-challenged MPI undergoes a delisting process looks like a political maneuver rather than merely about "investments"—as presented by the consensus.

If anything, MPI's episode showcases why the BSP has been dithering over its policies. The BSP's "trickle-down" effect is in jeopardy, demonstrated by the debt-to-eyeballs firms of the elites, which are on the precipice.

___

references

Prudent Investor, Is the Delisting of Metro Pacific a Bullish or Bearish Sign for the Philippine PSE? May 3, 2023: Substack, Blogger

No comments:

Post a Comment