How the PSE, Philippine Treasury Markets and the USD-Php Performed in June 2023 or the 1st Semester

Here is a short review of the performance of Philippine financial assets last June.

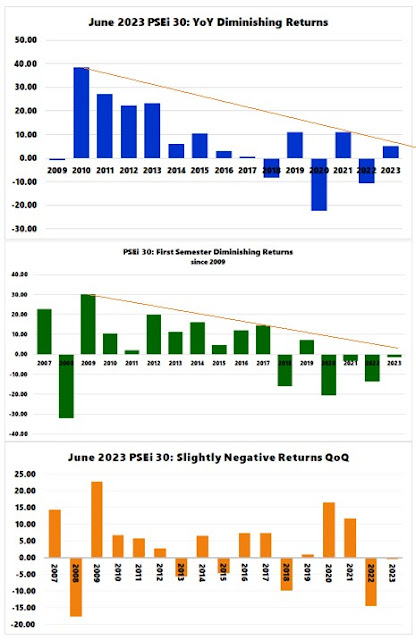

June 2023: Diminishing YoY and Semestral Returns

Let us start with the PSE.

Figure 1

The PSEi 30 closed the month of June (2023) up by 5.08% Year-on-Year (YoY), lower by 1.5% Year-to-Date (YTD), and down slightly by .5% Quarter on Quarter (Q-Q).

Since the 2010 peak, which rewarded investors with a splendid 38.34% return, the law of diminishing returns has plagued the PSEi 30. Or the yields have declined with 3 of the last eight years in negative.

It is the same story viewed from a semestral basis, diminishing returns with deficits in 3 of the last eight years.

It was more volatile in Q-Q. Including this year, decliners accounted for 35% of the last 17 years. Put differently, based on seasonal criteria, the 2Q used to be a bailiwick of the bulls. The last two years saw the bears encroach upon this stronghold.

June 2023: Financials Defy the Onslaught of the Bears; Cushioned the PSEi 30

The PSE performance by sectors.

Figure 2

Financials braved the bear market and posted magnificent gains of 12.3% YTD and 28.06% YoY.

The holding firms registered a .73% YTD decrease but generated a positive 11.65% YoY.

The property sector bore the brunt of inflation and the BSP rate hikes, down 10.95% YTD and 8.02% YoY.

Three sectors were up YoY (Financials, Holding, and Financials), while three closed lower.

The only sector in the positive YTD was the financials, which means that the sluggish output of most industries in the 1H semester weighed on the YoY returns.

Two sectors, financials and holdings, defied the bearish forces that engulfed the rest.

The takeaway is that the reason the PSEi 30 remains at around the 6,500 level has been because of the financials, which not only resisted the bearish assault, it also cushioned the index from falling lower.

June 2023: Philippine Treasury Curve’s Bearish Flattener

Figure 3

Inflation is not the only factor, but yields of fixed-income assets compete with equities for the public's savings.

In the fixed-income world, rising yields equate to falling prices.

Nonetheless, in June 2023, the Treasury curve transitioned with the dominance of rising short-dated rates—bearish flattener—a sign of financial tightening.

T-Bill rates have risen on all spectrums: YoY, YTD, and Q-Q. Previously steeper curves of December 2022 and March 2023 have become flat at the end of June.

It exhibits higher funding costs of credit.

It is no surprise that time deposits of the banking system have become a lightning rod from the inflation-induced BSP rate hikes as many savers stampeded to shield their peso from further losses in its purchasing power by locking into higher yield deposit accounts.

Notwithstanding, will banks continue to breeze over an environment of higher funding costs that could likely narrow their net margins? And how about the investment side, where asset prices remain under pressure?

June 2023: Mixed USD-Php Performance, But Peso Momentum Points to Strengthening

Figure 4

Finally, the peso ended June on a firm note YTD but fell against the USD YoY and Q-Q.

The USD has weakened against the peso (-1.69% MoM) on dwindling volume.

Momentum-wise, the USD-Php could weaken further over the interim.

Ironically, even under a weakening USD, Phiref rates--interbank FX swap rates--continue to climb. Could the BSP and banks have been borrowing FX and selling them to support the peso?

With half of 2023 finished, will domestic assets stage a strong rally in 2H, or will bears reassert their strength?

No comments:

Post a Comment