Desperate times call for desperate measures. Who is forcing up the PSEi 30?

If the Chinese had encountered the same rescue efforts of its stock market, the media would call it the work of the "national team."

Here in the Philippines, the public accepts the brazen manipulation of the index as the standard.

Further, "window dressing" represents the typical attributions of end-of-the-month volatility by the media and experts.

Such dismal developments represent a decaying market that has morphed into a rigged casino (in my humble opinion).

The enumerated bullets below represent the stunning developments of the November 29th session.

-Following the US market, the PSEi 30 opens the day downward.

Figure 1

-It dropped to a low of about 6,600 or was down by 1.2% before the lunch break.

-At the reopening, the "afternoon delight" operations began.

-A massive and coordinated pumping of select issues erased almost all the losses before the transition to the close. The index was down by .05% at the start of the pre-closing period.

-After the 5-minute pre-closing interval, the PSEi 30 was up by a spectacular 1.49% or 102.78 points!

-From 6,600 to 6,780, the PSEi registered volatility of at least 2.7%!

-A 10-issue pump sent it higher. The most remarkable: JGS rocketed by 8.4%! Yes, 8.4% after a 5-minute float! AEV spiked by 6.5%! ALI by 5.2%!

Figure 2

-Metrobank, URC, and TEL even reversed losses to end the session higher! The table provides its breakdown.

Figure 3

-Considerable losses of GTCAP (6.6%), MPI (4.16%), and CNVRG (3.98%) represented the top 20 traded issues in peso volume. The cumulative volume of these issues constituted about half of the top 20!

-These massive pumps were designed to offset them. Yet, their aggregate volume was significantly LESS than the top 3!

-Trade of the top 20 accounted for 91% of the aggregate daily mainboard volume. This data again shows how the compression of trading activities centered on a few issues.

-The main board volume spiked to Php 22 billion and lifted the number of trades.

-The top 10 brokers controlled 73% of the day's transactions! Even more, the top 5 corralled 54%, which translates to a massive concentration of trades among a few brokers.

Big volume for big brokers, which comes at the expense of the others (114).

Needless to say, the restricted participation and transactions shaped the headline performance.

-The broader market diverged from the index, and the sellers dominated (88-103).

Figure 4

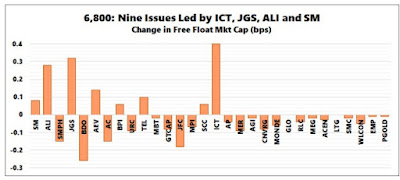

-In the last two days, only 9 of the 30 PSEi 30 issues posted increases in the free float market capitalization! ICT posted the most gains, along with JGS, ALI, AEV, and SM. So, not even the rest of the PSEi 30 components shared the sentiment exuded by the headline performance.

The November 29 pump was entirely about painting the tape, confirming the artificiality of the "in-your-face" inflationary bear market rally. And if I am not mistaken, it's part of the design to save the domestic financial industry.

Desperate times call for desperate measures.

No comments:

Post a Comment