It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. [I]f the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with 'free banking.' The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy—Paul Volcker, former Chairman of the US Federal Reserve

In this issue

September CPI’s 6.9%: Bank Consumer Credit Balloons, Salary Loans Explode for the Second Month!

I. September CPI’s 6.9%: Why Actual Inflation Must Be Higher than Reported Inflation

II. Consumer "Excess Demand": Bank Credit Loans Balloon, Salary Loans Explode for the Second Month!

III. Consumer "Excess Demand": Consumers and Business' Drawdown from Bank’s Peso Deposits

IV. Divergent Manufacturing Developments: Markit’s Bullish Take, Mactan’s Export Industry’s Massive Layoffs and Official "Stagflation" Data

V. Conclusion

September CPI’s 6.9%: Bank Consumer Credit Balloons, Salary Loans Explode for the Second Month!

I. September CPI’s 6.9%: Why Actual Inflation Must Be Higher than Reported Inflation

We shall start with two excerpts from social media.

ABS-CBN News Tweeter: October 7: The Philippine Amalgamated Supermarkets Association expects prices to go up further. Its head Steven Cua said almost all items at grocery stores are imported either in ingredients or packaging, hence a weak peso raises prices. Cua on grocery price hike: Kung 'di ka nag-review ng binibili mo, talagang malulula ka, magtataka ka. Dating 21 items in my cart, walong items na lang kasya. [Google Translate: If you don't review what you buy, you will be really disappointed, you will be surprised. There used to be 21 items in my cart, now only eight items fit.]

GMA News October 8 "To control inflation, NEDA exec tells consumers": Don’t buy excessively: As inflation rate is expected to remain elevated throughout the rest of the year, especially during the holiday season, a top official of the National Economic and Development Authority (NEDA) on Saturday advised consumers to control their purchases to arrest further increase in prices.

The first quote signifies an intuition by an official from the private sector representative of a group of groceries and supermarkets. The comment focuses on the dramatic (figurative 62%!) fall in purchasing power of the peso in the context of a grocery basket absent time references.

However, according to the BSP, based on 2018 prices, the peso's purchasing power has dropped by only 14% from June 2018 to August 2022.

In overlapping the 2012 data with the present, the peso's purchasing power declined by about 27% from January 2012 to August 2022.

It's a small beer from their end.

Yes, comparing intuition with official statistics is apple-to-oranges. And there may be some exaggeration in the cited anecdote, but the difference is just too stark to ignore.

Nonetheless, if people can buy only eight different goods from the erstwhile basket of 21 diverse goods, shouldn't the prices of the unbought goods fall, regardless of whether higher prices are a function of "imported inflation" or not? Why should prices go up across the board when the public can only buy fewer units at higher prices?

And isn't inflation about "too much money chasing too few goods"? If so, how is it that the public has too much money?

Who is responsible for that?

In reality, increases in purchasing power via slightly falling prices are consequences of a boom in productivity, jobs, and income from capital investment expansion in a stable money environment.

Improved standards of living come to the public from the fruits of capital investment. Increased productivity tends to lower prices (and costs) and thereby distribute the fruits of free enterprise to all the public, raising the standard of living of all consumers. Forcible propping up of the price level prevents this spread of higher living standards. (Rothbard, 1963)

But that is hardly the goal of the BSP, which uses inflation targeting as the framework for its monetary policies.

Under inflation targeting, the central bank compares actual headline inflation against inflation forecasts. The central bank uses various monetary policy instruments at its disposal to achieve the inflation target. (BSP, 2020)

Their problem is that the inflation genie escaped from its proverbial lamp to have triggered instability. What seemed to have worked before has boomeranged.

Authorities and the establishment, who dismissed its time-inconsistent and asymmetrical repercussions, are now faced with the bust phase of a boom-bust cycle it fostered.

With the CPI running wild, the distraught establishment consensus has scampered to explain away or rationalize it. "We are in control," as they implicitly say.

Figure 1

Officials reported that September CPI was 6.9%, the highest since July 2008. Of course, the integrated data shown by tradingeconomics.com discounts the different rebasing of prices used to calculate the CPI.

In any event, the CPI chart evinces a massive rounding bottom suggesting a colossal upside ahead. (Figure 1, topmost pane)

Had the 2012 price been used, the CPI would have been at 7.6-7.7%. And it would be much higher if calculated based on the 2006 prices (above 8%).

For instance, the difference between the CORE CPI based on 2018 and 2012 prices widened substantially in 2021. The diminished CORE CPI (2018 prices) contributed to the lower headline CPI.

The point of the above is that the CPI will be tailor-fitted to paint a rosy picture to meet the economic agenda of the political leadership and institutions. Remember that the calculation of the real GDP through the PCE depends on many segments of the CPI.

That said, suppression of the CPI boosts the headline GDP. And that is just one of the benefits for the government.

All these indicate: actual inflation must be substantially higher than reported inflation.

II. Consumer "Excess Demand": Bank Consumer Credit Balloons, Salary Loans Explode for the Second Month!

Despite the 175 bps increase by the BSP from April, total universal and commercial bank lending reportedly expanded at a faster 12.11% in August.

While on a YoY basis, bank lending growth rates surged from information and communications (28.56%), Other community & Social Activities (28.23%), and Utilities (21.76%), the growth numbers represented mainly the low-base effect.

In pesos YoY, the top three industries were the real estate sector (Php 255.2 billion), manufacturing (Php 165.7 billion), and consumers (Php 146.8 billion).

Again in pesos, manufacturing (Php 40.06 billion), trade (Php 23.6 billion), and consumers (Php 16.1 billion) signified the largest borrowers (month-on-month).

The defining factor for the YoY and MoM performance is consumer borrowing.

While the surge in interest rates should be putting a cap on bank lending, we surmise that perhaps, thinking that rates will further rise, bank borrowers have been frontrunning the loan uptake.

The most eye-catching data from the bank credit portfolio remains the swelling of consumer loans.

Figure 2

Credit card loan YoY growth in August accelerated to 24.4% from 21.04% a month ago. In pesos, credit card loan volume carved a fresh record high of Php 497 billion. (Figure 2, upper and middle windows)

The massive increases in balance sheet leveraging by consumers could primarily represent the desire to maintain spending power in response to the loss of purchasing power of the peso from the ravages of inflation.

The other critical factor could be consumers taking advantage of the interest cap on credit cards imposed by the BSP, coming at the expense of the banking system.

But the more significant development is that universal bank salary loan growth zoomed by 51.9% following the brisk 39.2% last July. Both velocity and levels (Php 112.9 billion) reached a new record! (Figure 2, lowest window)

Again, this excludes salary loans provided by direct employer loans and non-bank credit providers.

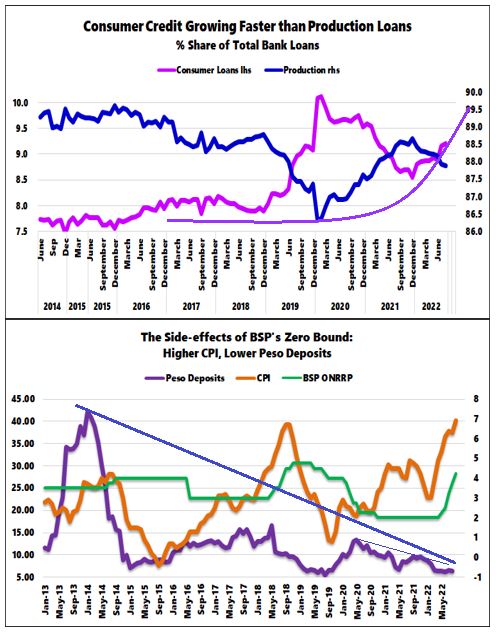

To this end, the share of consumer credit and credit card loans relative to the total bank credit portfolio continued with its upward swing taking the toll of the share of production loans. (Figure 3, upper window)

Naturally, with the boom in credit-financed spending, the supply side or wholesale and retail bank credit also flourished.

Interestingly, official labor data showed that "UNEMPLOYMENT RATE inched up month on month in August, while job quality continued to worsen," according to the Businessworld.

While the accuracy of the labor data may be suspicious, as authorities have the propensity to embellish it, the market is practically saying that the current job and income conditions are insufficient to fuel "excess demand."

Because of inflation, the thrust of bank lending operations has shifted to consumer-related spending, amplifying the industry's risk profile.

Banks have not only transitioned from lending to asset speculations, but the core operations have also segued towards consumption loans.

And paradoxically, the mainstream calls this "sound."

As an aside, this post excludes the fiscal spending side of inflation.

III. Consumer "Excess Demand": Consumers and Business' Drawdown from Bank’s Peso Deposits

And to add to this perspective, peso deposits growth of the banking system continues to slide in the face of higher inflation. (Figure 3, lower window)

Despite the jump in bank lending, peso deposit liabilities grew 6.42% in August from 6.6% a month ago.

Since 2013, it has been a downtrend in peso deposit liabilities growth.

The tempo of the declining trajectory picked up in May 2020 following its short rebound in response to the BSP historic injections.

The pandemic must have forced many to draw down their savings, while today's stagflation must be exacerbating the same pressure.

Finally, haven't you noticed? With the decreasing trend of deposit growth, some banks are issuing costly bonds to fund their operations.

IV. Divergent Manufacturing Developments: Markit’s Bullish Take, Mactan’s Export Industry’s Massive Layoffs and Official "Stagflation" Data

Are these two developments talking about the same country? (bold highlights mine)

First, a survey…

S&P Markit, October 3: The two largest sub-components of the PMI (output and new orders), rose during the latest survey period. The rates of increase were only moderate, but a welcome change from the preceding two survey periods. According to anecdotal evidence, greater client appetite helped boost factory orders, with firms then scaling up production. Though Filipino manufacturers saw inflows of new business increase during September, foreign demand for Filipino manufactured goods weakened, thereby extending the current run of contraction to seven months, and suggesting that growth was primarily driven by domestic demand. In line with greater output, firms purchased additional inputs for use in the production process. The respective seasonally adjusted index registered above the 50.0 no-change mark after signalling a contraction in the previous survey period. Moreover, with firms anticipating greater demand, holdings of both pre- and post-production stocks increased. The upturns for both quickened from those seen in August In line with greater new sales across the manufacturing sector, companies continued to add to their payroll numbers. Firms expanded their workforce numbers at the second fastest rate in the current five-month sequence of increase. As has been the case since August 2019, vendor performance deteriorated again during September. Moreover, the extent to which average lead times lengthened was the greatest in six months and sharp overall. Shipping delays and post congestion were largely blamed for the deterioration. As a result of improved demand conditions and persistent supply-chain pressures, Filipino goods producers reported their first increase in work outstanding since February 2016. Turning to prices, inflationary pressures eased during September. The rate of input price inflation eased to a 20-month low and charges levied increased at a softer rate than that seen in August. That said, the pace of charge inflation was still historically elevated with firms choosing to pass costs on to customers.

Next, a news…

GMA News, October 5: A total of 4,203 workers lost their jobs after the Mactan Export Processing Zone (MEPZ) trimmed down its employees due to the high price of petroleum products. According to a report by Lou-Anne Mae Rondina on "24 Oras," most employees were from apparel companies selling products outside the country. In a statement, MEPZ said they were forced to cut workers because of the effects of the COVID-19 pandemic, Typhoon Odette, and the current global recession.

Of course, the conditions of the entire country may not be similar to the predicament in Mactan Cebu.

But let us analyze both of their conditions.

The summary of the Markit survey is as follows:

-Local demand for manufactured goods improved while foreign demand weakened.

-Manufacturers increased input and output stocks and increased their workforce.

-Supply chain bottlenecks worsened due to further deterioration of vendor performance.

-While input prices softened, pass-through to consumers resulted in higher output prices.

Meanwhile, the events in the export zone of Mactan corroborated the lower foreign demand outlook amidst higher input costs, resulting in mass layoffs.

Higher prices have misled manufacturers to think this is about "growth."

In so doing, they have stockpiled inputs (raw materials and semi-processed goods) and finished products. They seem to be banking on the sustainability of domestic activities even as foreign demand has faltered for several months.

Manufacturers appear to have fallen into the Bullwhip effect trap or "how small fluctuations in demand at the retail level can cause progressively larger fluctuations in demand at the wholesale, distributor, manufacturer, and raw material supplier levels." (Daniel, 2019)

As it is, once prices increase to levels that diminish the quantity demanded, these manufacturers will likely suffer from a glut.

Though one can question the accuracy of the Philippine Statistical Authority (PSA) data on manufacturing, if it reflects some reality, then most firms in the industry might be in trouble.

Here is the thing.

Figure 4

Manufacturing value and volume have diverged significantly. The same discrepancy reflects in the industry's net sales.

While the industry reported a surge in the sales and production value, their respective quantity or volume (sales and production) has lagged. The industry posted value growth rates of 11% in production and 26% in net sales in August. But the registered volume growth rates were substantially lower at 3.5% and 17%, respectively. (Figure 4, top and middle panes)

This disparity showcases the "money illusion," where value increases represent inflation than actual unit growth.

Such "money illusion" is traceable to the surge in manufacturing loans to reflect increased stockpiles and operations, which influenced the PPI or output inflation. Manufacturing loans expanded by 15.9% in August. (Figure 4, lowest pane)

"Imported inflation" via higher energy prices and supply chain gridlock escalated input price pressures of the industry.

At the end of the day, the synchronized uptrend of manufacturing bank loans and the PPI exhibits the "excess demand" factor.

And there's more.

With the CPI lower than the speed of price changes of output prices of producers, this implies that wholesalers and retailers should be experiencing a profit margin squeeze. The Mactan episode may be a paragon to many more firms at the risk of accruing losses.

But if the wholesale and retail firms can pass through the price hikes to consumers, this data represents circumstantial evidence of the understatement of the CPI.

V. Conclusion

In any case, surging inflation represents a feedback mechanism from existing monetary and fiscal policies. It also aggravates the problems in the division of labor through resource and financial allocations, business calculations, capital consumption, and the coordinating mechanism of the marketplace compounding on the feedback loop.

With the BSP fixated on maintaining its "inflation target" designed to finance the political boondoggles, why wouldn't inflation become an entrenched trend?

Besides, the BSP is aware of the factors that fuel inflation but insists on defying these. Should we be surprised that these policies backfire?

No comments:

Post a Comment